what does a stock being oversold mean

As per my reading on this topic it seems like Oversold is when a stock is trading below its expected value and Overbought is when it is trading about the expected value. Oversold stocks are undervalued.

Overbought Stocks Meaning Rsi Indicator Vs Oversold Strategy

You can buy the stock and sometimes see quick returns as it rebounds.

. When a security in the stock market is oversold this means that the securitys price has dropped below its true value in a short period of. Using the same logic of an overbought stock the fact that a stock is oversold does not mean it is an underperforming stock. When a particular market instrument is sold continuously investors think the assets price has hit rock bottomthe asset becomes oversold.

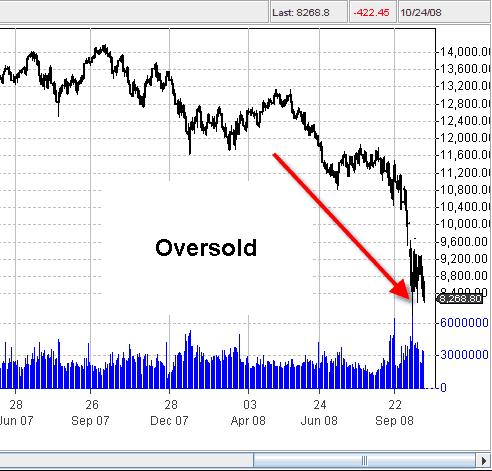

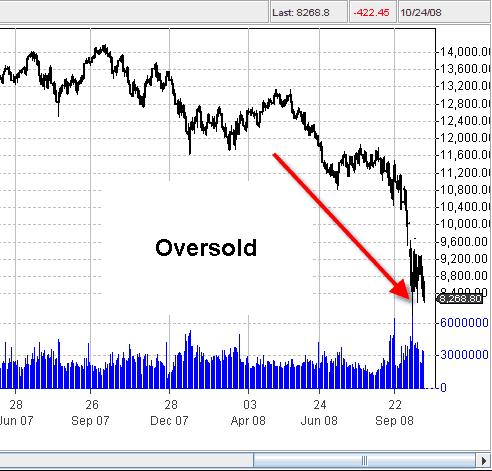

Also the term oversold and overbought gets associated when there is a sudden drop or spike in price. A stock a market sector or an entire market may be described as oversold if it suddenly drops sharply in price despite the fact that the countrys economic outlook remains positive. You can consider a stock is over-sold as long as it is trading at prices below its intrinsic value or actual value.

This could happen for various reasons including bad news about the company or its industry. However the determination of accurate expected value of a stock is the where all the research comes in. This scenario signals the end of short-term declines and the beginning of an upward rally.

Therefore an impending price bounce is highly likely. Just because a stock is oversold doesnt mean its cheap a stock can continue to collapse for years if the company is under performing. Oversold stock meaning An oversold stock means that a companys shares are currently under heavy selling pressure but have the potential to bounce back.

While the sell-off has caused its share price to decrease dramatically the new lower price does not reflect the assets true value so its likely a price rally will follow. For technical analysts an oversold market is poised for a price rise since there would be few sellers left to push the price down further. When investors sell so much stock that the price falls below its actual value it has become oversold.

If you ask a fundamental investor he may justify it on the basic of intrinsic value. Its a technical term an oversold stock means the stock has been sold way too much and its considered a good time to buy usually for swing traders for short term gains. Oversold means the stock is worth more than what it is currently selling at.

When a stock becomes oversold though its a good thing for new investors. If you ask a trader he may justify on the basis of charts or indicators. This can happen when the market overreacts to a piece of information.

The opposite of a stock being overbought is a stock that is oversold. An oversold stock means that a companys shares are currently under heavy selling pressure but have the potential to bounce back. Typically oversold stock means that the supply of shares outweighs demand.

An oversold stock is a stock that is trading at a discount to its intrinsic value. The catch is its hard to agree what the stock is worth. One of the common ways to notice trends for stocks that are overbought or oversold is by.

What does it mean when they say a stock is oversold.

Overbought Vs Oversold And What This Means For Traders

Oversold Stocks Screener Marketvolume Com

/dotdash_Final_Oversold_Dec_2020-01-83bb8abb9e44484986e604f4bcbacc5a.jpg)

Oversold Definition And Example

Overbought Vs Oversold And What This Means For Traders

New Scans Strong Oversold Stocks And Weak Swingtradebot Com

Oversold Meaning Indicators Examples Vs Oversold

What Does An Oversold Stock Mean Would It Be A Good Buy Quora

How To Know If A Stock Is Overbought Or Oversold Quora

Overbought Vs Oversold And What This Means For Traders

Oversold Stocks Most Oversold Stocks Today

Overbought Vs Oversold And What This Means For Traders

/dotdash_Final_Overbought_or_Oversold_v1_Use_the_Relative_Strength_Index_to_Find_Out_Oct_2020-01-423bbf70a2224158a165ae090b8277ae.jpg)

Rsi Indicator Evaluate Stocks As Overbought Or Oversold

Oversold Markets 4 Things To Consider

/dotdash_Final_Oversold_Dec_2020-01-83bb8abb9e44484986e604f4bcbacc5a.jpg)

Oversold Definition And Example

Determining Overbought And Oversold Conditions Using Indicators

:max_bytes(150000):strip_icc()/dotdash_Final_Overbought_Sep_2020-013-385b6e73c3ce438e939375ab17150be1.jpg)

/dotdash_Final_Overbought_Sep_2020-013-385b6e73c3ce438e939375ab17150be1.jpg)

/dotdash_Final_Overbought_Sep_2020-013-385b6e73c3ce438e939375ab17150be1.jpg)